Admin

Introduction to the Blog Summary

This blog guides businesses on leveraging new product development research to successfully launch and sustain products in a competitive market, emphasizing the importance of data-driven decision-making.

Key Points Overview

Top Takeaways

Conclusion

Effective new product development research enables businesses to turn ideas into successful products by providing actionable insights and minimizing the risk of failure. Utilizing platforms like Quid ensures data-driven strategies, improving product innovation and market positioning.

Are you thinking of bringing a new product to the market this year? Congratulations, yours will be one of more than 30,000 new entries! We’re going to help you stand out.

Yes, there are indeed that many new products being introduced to the market every year, according to Harvard Business School. However, it is estimated that an overwhelming majority of them fail.

“Many new products fail because their creators use an ineffective market segmentation mechanism. It’s time for companies to look at products the way customers do: as a way to get a job done.” – Harvard Business School.

Still want to launch? Have you rigorously tested your concept, developed a plan to turn it into a business, designed the product, and created a sound strategy for market entry?

And those are just four of the seven boxes you need to check if you really want your product to succeed. But don’t panic. If you conduct new product development research, you will gain the necessary consumer and market intelligence to make it among the few new products that survive and keep on thriving.

New product development is the process of bringing a new product to the market! And to do that, businesses conduct ongoing market research throughout the process to ensure they are creating a product based on intelligence rather than intuition. This is key.

So, market research tailored specifically to the success of a new product in the market is what is referred to as new product development research. It comprises primary and secondary, qualitative and quantitative research methods used in other forms of market research––but the difference is in the goals.

When you understand the role of new product development research, you will appreciate the process more and hopefully incorporate it in your current or future projects.

Net Solutions has laid out a beautiful illustration of the product development process. It is broken down into seven stages; but keep in mind that product development is an ongoing process throughout the life cycle of the product or service. Iteration happens even when the product in question isn’t broken.

While Net Solutions’ tutorial is focused on tech product development, we are going to use the steps to show you the role of new product development research in the process for any type of product.

Good business ideas come with a solution to an existing problem or a way to improve the way things are done. There are many sources for good ideas starting with personal struggles, anecdotal information, access to relevant data, and concerted efforts in research and development.

When organizations need to come up with fresh ideas, a deliberate effort must be made. Since investing in research and development is out of reach for most businesses, brainstorming and new product market research is the surest path.

An organization’s proprietary, CRM, sales, and operation data – internal secondary research – may reveal previously hidden opportunities behind customer feedback or employee experiences at work.

While this often helps with the improvement of the current product, it sometimes leads to the development of entirely new products. Productivity apps are often created this way.

Ideas may also come from qualitative and quantitative research through surveys, interviews, and direct observation. This is a good approach for people starting out in business when they don’t have access to sufficient volumes of internal data.

Thirdly, ideas may be generated by analyzing consumer conversations and news media data on social media, review sites, and discussion forums through advanced techniques such as web scraping, social listening, and sentiment analysis. This way, potential markets are identified based on themes in natural consumer conversations and trends.

The first step is essential to exploring the open avenues, but it is not enough to determine the viability of any single idea. The second stage is idea screening where the feasibility of the idea as a business opportunity is determined.

Through new product development research, the organization can pick one idea to pursue – you don’t want to implement multiple ideas at a go. The SWOT analysis is a great way to screen ideas by comparing them to the market and to each other.

The strengths of an idea are the internal attributes that make it viable. If it solves an obvious problem, then the product or service will face less difficulty during market entry. Even better is if it can be developed easily and cheaply, which makes it more affordable.

An idea may require a large initial capital investment, or the end product may depend on third parties. These internal attributes are weaknesses which make it less viable.

Opportunities around an idea may be other verticals to where it may be extended into other categories adjacent to the brand. Or there might be added benefits that weren’t previously considered. For instance, an ecommerce store may collect customer data that can be shared with the producers to improve their businesses.

Threats to the idea include competition, high market regulation, and security risks.

New product development research can help answer such questions in the SWOT analysis through consumer data as well as the study of market factors such as production costs and distribution channels.

Concept development is about developing the idea to a point that it can be successfully explained to a potential customer i.e. they can buy into it. Starting at this stage, the new product development research focuses on the one idea that made it through the screening stage.

One on one interactions with target consumers can help the brand better understand the product from the user’s perspective. For instance, it can help study the balance between what the consumer gains and the tradeoff in using the product.

A modern consumer intelligence platform can help study trends and consumer expectations to create a compelling value proposition.

With an advanced market intelligence platform, the brand can understand the target market in terms of the existing competition and potential allies. The platform can also deploy its social listening antennas to find out the strengths and weaknesses of the competing products through consumer conversations and feedback.

The data gathered is analyzed and the insights used to improve the concept before proceeding to build a business on it.

After proof of concept is established, the business framework should be created before going any further with the development of the product itself. This includes how to market, price, and deliver the product.

New product development research can be used to compare the different marketing avenues available to the brand (based on budget and target audience). Social listening can help study the voice of the customer and the insights used to craft marketing messages in a way that appeals to the audience.

Other than the cost of production, other factors may influence the price of the product. Brands use secondary research to determine their pricing model through benchmarking. Modern methods such as sentiment analysis can help understand how consumers feel about the current prices, bringing in a third factor.

Delivering the product here refers to how the buyer obtains value from your product or service. Through focus groups, the brand can get a closer look at how consumers perceive the concept before it is developed into a product.

With a business plan on hand, the creator can proceed to make a prototype and a minimum viable product (MVP). These processes require both internal and external data.

A prototype is simply a visualized concept. It is important in cases where the creator needs the help of others such as VCs and talent to develop the product. For both virtual and physical products, as well as services, research may involve methods such as observation and use of existing products and interviews with experts.

An MVP is a step above prototype because it works. It does the most basic set of functions the product is designed to do. Testing data – internal secondary research – is invaluable during the improvement of the MVP into a product that’s ready to launch.

The product launch is probably the most crucial stage in the new product development process. Products that don’t hit their targets at launch rarely recover. On the other hand, those that succeed at launch are likely to maintain their trajectory.

As such, new product development research is critical to understanding consumer motivations, timing the launch, and communicating effectively with the target.

Understanding consumer motivations for seeking such a solution as you have will help build anticipation for the launch. Surveys can be used to get direct feedback about individual struggles of the target consumers while social listening can be used to listen in as they share their experiences with each other.

Social listening can also reveal the trends and mood of the target consumers in order to launch the product under the most auspicious circumstances.

Post launch, the new business is primarily focused on building a reputable image i.e. brand development. This means promoting the product and fostering a good relationship with the customers.

Consumer research helps understand how buyers are using the product to solve their problems. This feedback may be shared directly through email, social media DMs and comments, or business websites. It can also be expressed indirectly through social media posts, external review sites, and forums.

Capturing consumer data through CRM software is the first step to building a strong relationship with the customers. Analysis of the data over time provides useful intelligence upon which to base strategic decisions.

New product development research should be conducted across all industries, not just tech products. And not just for products but for services too.

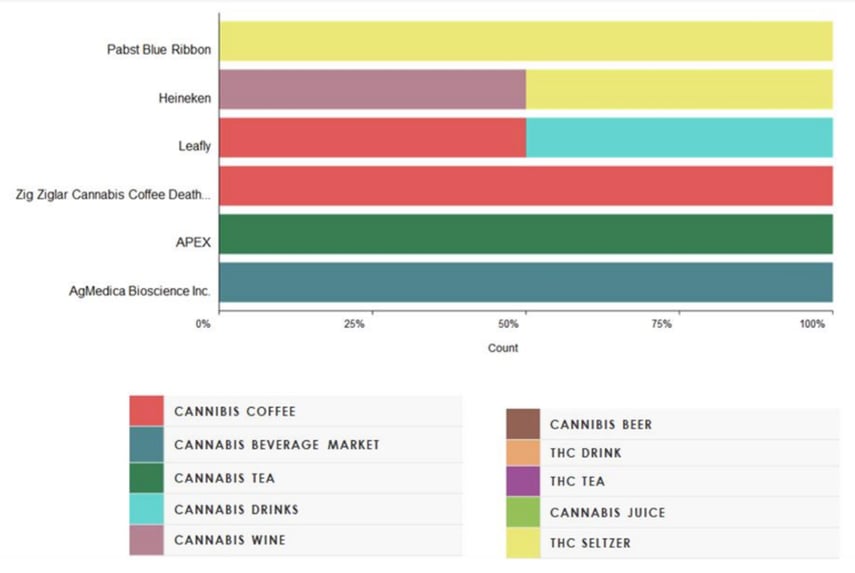

For instance, a major beverage manufacturer recently used NetBase Quid® to look into the cannabis-infused beverage trend. They think that it is an area of interest and although they are not making any decisions yet on entering the market, they still want to know what’s going on.

The idea came to them after having noticed a growth in news coverage on the subject. This was their idea generation stage.

So, they used Quid to look into it to see who was driving the conversation and determine whether it was a solid trend or passing fad. If it turned out to be a trend, this would be a legit signal for an emerging market opportunity for them. This is idea screening.

They went further into the analysis to see how consumers were using cannabis. For instance, were they using it with or in beverages; what kinds of beverages; and were there any preferred brands and why? Concept development has taken shape and this is where they currently are.

Cannabis-infused beverages.

The business analysis stage shouldn’t be too complicated for them as they are already manufacturing beverages. Through concept development, they will have determined the best way to introduce cannabis beverages to the target market.

Through product development, they would use the insights gathered from the first adopters to improve the product.

Next would be the product launch guided by comprehensive data analysis then a data-driven strategy to establish themselves as a leading brand in the category.

New product development research is an invaluable aspect of the process of turning an idea into a sustainable business.

If more than nine out of every 10 new products launched are failing, it’s because the majority of creators aren’t following the process. If they did, we’d have far fewer products being launched and a much higher success rate.

New product development research can tell you when to proceed and when to take a step back. It can help you discover the thing in your idea that makes it irrelevant to the market or poorly timed so you don’t waste your resources on a failed project.

On the flip side, it can give you the confidence you need to keep improving until you have the perfect solution for the problem you have identified.

Not only can Quid collect and analyze consumer and market data at large scale, the platform allows you to do it quickly, repeatedly, and inexpensively compared to traditional research. This means you have all the information you need, at all times, and more time to focus on making your product better.

Reach out for a demo today to get a special introduction to the platform by one of our in-house experts!